The USA has a progressive tax system, where a higher tax rate is imposed as income increases. This system works to reduce the taxes for those with a low ability to pay and shifts more of the tax to those with a higher ability to pay. The US has seven income tax brackets for 2021 that range from 10% to 37%. To put the 37% in perspective for our high-income earners: the US had a top tax rate of 77% in 1918 to finance World War I, and 94% in 1944 to finance World War II.

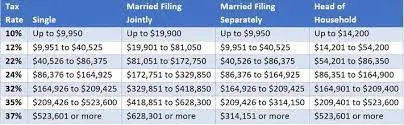

The tax rate progressively increases as taxable income increases in the brackets. The brackets are based on your filing status: they differ if you are single, married filing jointly, married filing separately, or head of household. Due to the brackets, all single individuals will pay tax at a 10% rate for taxable income between $0 and $9,950. If your income is higher than this, the income earned above $9,950 is taxed at the higher rate, but the initial $9,950 stays in the 10% tax bracket.

Let us walk through an example. Assume that a single taxpayer has a taxable income of $55,000 for 2021. Looking at the brackets, you will see that $55,000 falls in the third bracket with a Marginal tax rate of 22% (Marginal tax rate is the highest bracket that a taxpayer falls into). If the tax rate was not progressive, the tax owed would be $55,000 x 22% = $12,100, but that’s not how tax works in the US.

Instead, the first $9,950 of income is taxed at 10% for a total of $995. The income in the second bracket is the taxable income from $9,951 to $40,525. This income bracket will be taxed at a 12% tax rate: 40,525 – 9,950 = $30,575 x 12% = $3,669. Then we look at just the income that falls into the third tax bracket for the 22% tax rate: $55,000 – 40,525 = $14,475 x 22% = $3,184.50. The total tax for this single individual is $995 + $ 3,669 + $3,184.50 = $7,848.50. The effective tax rate can be calculated by total tax paid divided by taxable income, or $7,848.50 / $55,000 = 14.27%. So, a single taxpayer with $55,000 of income has a marginal tax rate of 22%, and an effective tax rate of $14.27%.

The result: a tax bill that is $4,251.50 lower than if the entire taxable income was taxed at the marginal tax rate.