The two main ways to reduce your tax bill include tax credits and tax deductions.

Tax credits are calculated after the tax is determined, meaning that they will reduce the tax you owe but they have no effect on your tax bracket. These are typically a dollar-for-dollar reduction of tax owed.

Tax deductions are calculated before the taxable income is determined, meaning that they reduce your taxable income which could reduce your tax bracket. These typically save the marginal tax rate percent (so a $1,000 tax deduction for someone in the 22% tax bracket would save them $220).

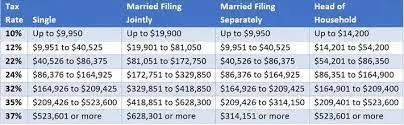

Let’s go back to our example from “progressive tax system, part 1 (link here please)” : single taxpayer with $55,000 of taxable income and a federal tax owed of $7,848.50. (see part 1 for the details of how this was calculated)

IF they had a tax deduction of $1,000 they would reduce their taxable income to $54,000. This still places them at a marginal tax rate of 22%, but only $13,475 of their income is taxed at 22%. Their new tax owed would be $7,628.50, a savings of $220, and a new effective tax rate of 14.13%.

IF they had a tax credit of $1,000 they would remain at taxable income of $55,000, and the marginal tax rate of 22%. However, their tax owed would drop to $6,848.50, a savings of $1,000, and a new effective tax rate of 12.45%

While tax credits then have the greatest effect on the tax owed and effective tax rate, they also have stricter qualifications to be able to earn these credits that typically includes an income limit as well. So tax deductions can be crucial in reducing taxable income enough to qualify for tax credits. Sound complicated? It is. So unless you like math, and learning about all the possible tax credits and deductions, you’ll want to work with a qualified tax professional to help ensure that you are taking all of the deductions and credits that you are eligible for. However, you must also realize that the things that effect your 2022 tax bill have to occur IN 2022 for the most part. So if you’re waiting until 2023’s “tax season” to think about your 2022 tax bill, you’re already too late to have the best effect. Find a professional that’s open year round and will do tax planning with you before year end, to improve your tax bill for the following spring.