Most forms have a date that they must be postmarked, or mailed by. Mail delivery time and delays could mean that the forms are not received until after the below listed deadlines but are still considered on time. Forms that are sent late, are subject to penalties, but it is possible that you will receive them after the listed deadlines in some cases. There is more information below the deadlines on what to do if you do not receive a tax form, or there are errors on the form that you receive.

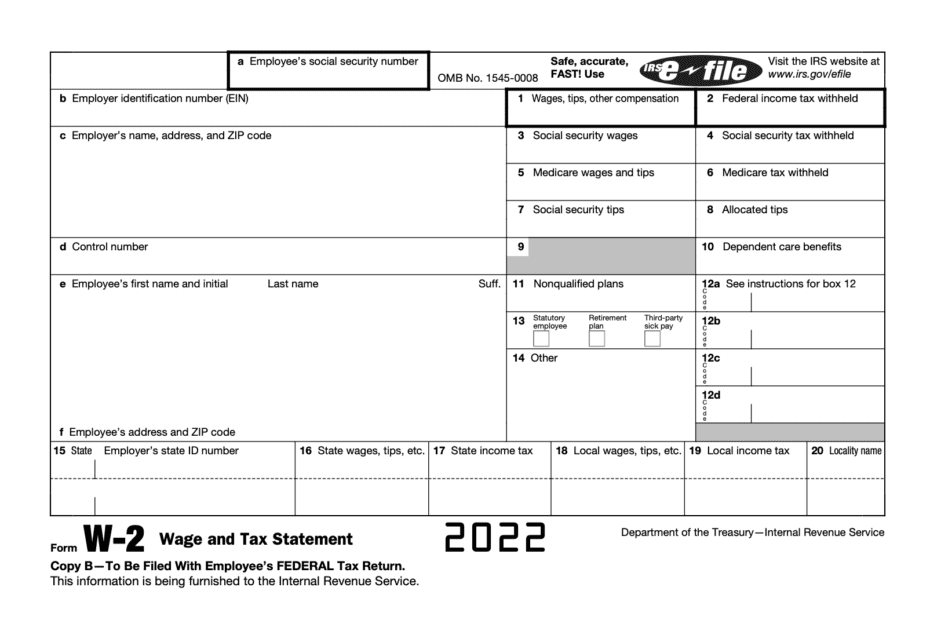

W2 Forms: Jan 31

This is a form that you receive from your employer, showing your income, the amount of tax that you had withheld from your pay, and tax information on benefits or retirement if applicable.

1099 Forms: Jan 31 for most

There are many types of 1099 forms, including Interest and dividends on investments, distributions from retirement plans, unemployment benefits, prior year refunds, rent received, and work performed when you are not an employee (called “non-employee compensation”).

Certain 1099 Forms: Feb 15 for some

These forms included brokerage statements, reports from the sale of real estate, proceeds paid to attorneys, and tax-exempt interest payments. These more complex forms are allowed the extended time for accuracy in their information.

1098 Forms: Jan 31

These forms include information that may be used on your tax return, including mortgage interest that you paid during the year, student loan interest payments, and tuition payments for higher education.

Schedule K-1: March 15 or can extend to September 15 respectively

Ownership interest in a business is reported to you on a Schedule K-1 and includes your portion of relevant information to be reported on your personal tax return. Businesses need to file the business tax return and send out the associated K-1(s) by the business tax return deadline in the spring. However, just as individuals are allowed to extend their tax returns, businesses are also able to request a 6 month extension of time to file the returns (and supply the K-1 forms).

Learn more:

Your tax documents are always tied to your Social Security Number, or SSN, (even if they are mailed to the wrong address). In most cases, you can file before receiving your tax documents if you know the amounts, but the tax return will be matched to these documents so filing early could cause you to have to amend. Additionally, a mismatch in the information on the forms and your tax return (when less income is reported than the form shows) will lead to delays in any refund due, potentially flag your return for more scrutiny or an audit, or could subject you to penalties and interest on additional tax owed. We strongly recommend that you wait to file until you have received all your tax documentation.

If it is after the above deadlines and you have not received a form, reach out to the provider of the form and request a copy. It could have been sent on time and did not reach you, such as being mailed to an old address if you moved and did not update the provider. If you have not received tax forms with a Jan 31 deadline by the end of February, you can call the IRS at 800-829-1040 for assistance (provide them with your personal information, dates of employment, the employer/payer’s name and contact information).

If you receive a tax document that has an incorrect address: contact the employer/payer and update the form if you expect that you will get another tax form the following year from them. There is no need for a corrected form to be issued, as the IRS will tie the information using your SSN and not the address. If there are any other errors, such as in your SSN or in the amounts paid, then the employer/payer will need to fix the error and send you a Corrected tax form. The deadline for these Corrected forms is based on when the error is found.